At present, there are two kinds of mainstream lithium cathode material projects in the market: LFP cathode material project and ternary cathode material project.

In recent one year, there is a total of around 30 expansion projects for cathode materials in China, with a planned capacity of more than 3.2 million MT/year. Number of LFP and ternary projects are basically the same.

A. Rongbai Technology

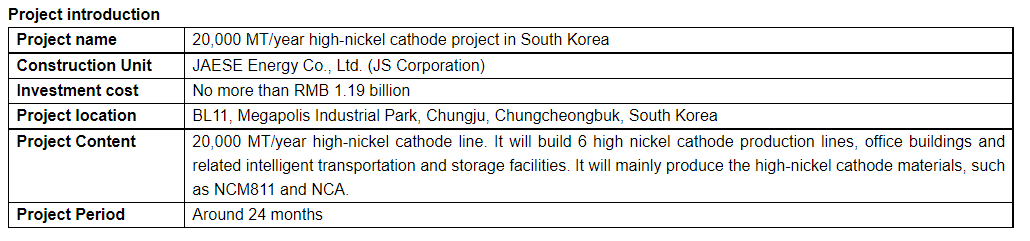

1. 20,000 MT/year high-nickel cathode project in South Korea

On October 30, 2020, Rongbai Technology announced that it planned to increase the capital in the subsidiary JAESE Energy with its own and self-financing funds up to RMB 1.19 billion in order to improve the company’s global strategic layout, enrich the company’s overseas sales channels and customer resources, and to enhance the company’s overall competitiveness and profitability. It will invest to build a 20,000 MT/year high nickel cathode project in South Korea, with capital increase of KRW 679 per share. The capital increase will be carried out in batches according to the project progress.

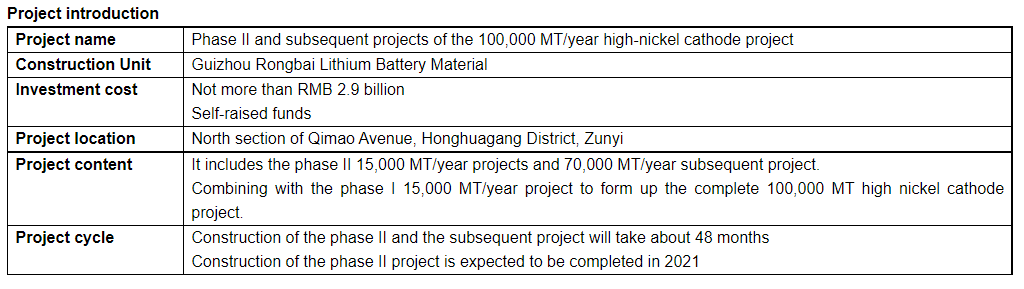

2. 100,000 MT/year high nickel cathode line (phase II and subsequent projects)

On February 9, 2021, Ningbo Rongbai announced that the phase I 15,000 MT/year of the “100,000 MT/year high-nickel cathode project”, which was built in cooperation with the wholly-owned subsidiary Guizhou Rongbai and Zunyi Honghuagang government, has been built up and put into operation in 2019. The company has decided to start the phase II and subsequent projects in 2021, and has signed up a cooperation agreement with Honghuagang government about the implementation period, project construction land, policy preferences and other contents. The investment and construction capital for the phase II and subsequent projects is expected to not exceed RMB 2.9 billion.

B. Dang Sheng Technology

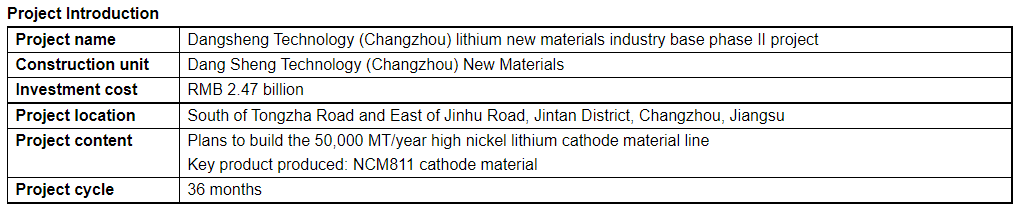

1. Dansheng Technology (Changzhou) Lithium New Material Industrial Base Phase II Project

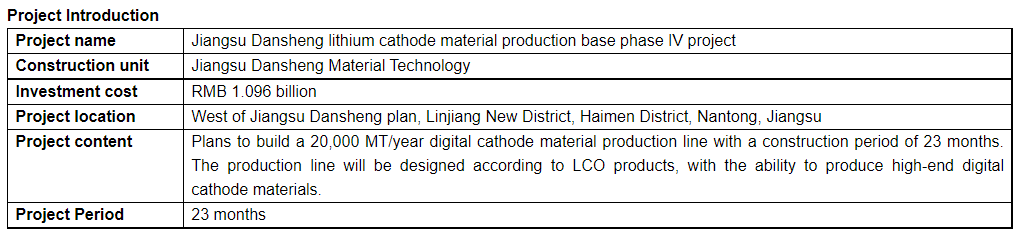

2. Jiangsu Dansheng lithium cathode material production base phase IV project

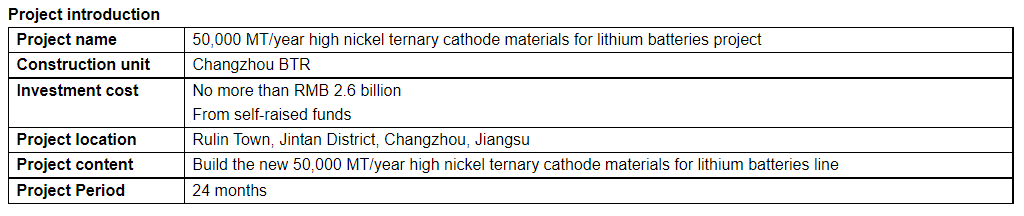

C. BTR

On May 17, 2021, BTR announced that its subsidiary BTR (Jiangsu) New Material Technology plans to sign up the Joint Venture Contract and the Capital Increase Agreement with SK Innovation and EVE Asia, which will increase the investment to BTR (Changzhou) and build the “50,000 MT/year high nickel ternary cathode material project” via the joint venture.

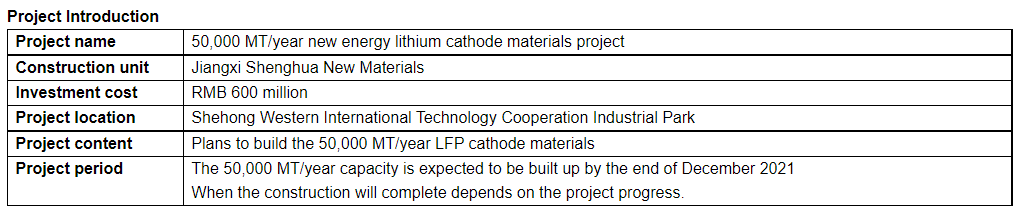

D: Fulin PM

1. 50,000 MT/year of new energy lithium cathode material project

On January 9, 2021, Fulin PM agreed that the subsidiary Jiangxi Shenghua New Material to build the 50,000 MT/year new energy lithium cathode materials project, with an estimated total investment of RMB 600 million.

Note: On March 17, 2021, Fulin announced that it agreed that the company and its wholly-owned subsidiary Jiangxi Shenghua New Materials to sign up an investment agreement with Ningde Times and Changjiang Daochen Hubei (Limited partnership) for capital increase in Jiangxi Shenghua.

Jiangxi Shenghua will introduce the investors via capital increasing. The investment obtained from the capital increase will only be used for the construction of the 50,000 MT/year LFP expansion project and the working capital.

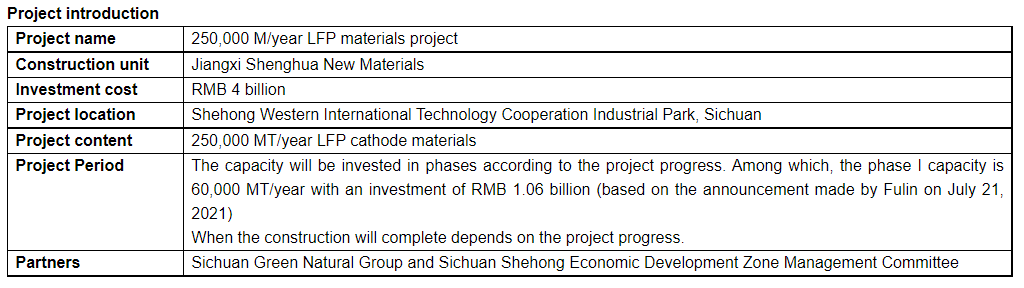

2. 250,000 MT/year of LFP cathode material project

On March 17, 2021, Fulin announced that it planned to build a 250,000 MT/year LFP cathode materials project through its subsidiary Jiangxi Shenghua New Materials, with an estimated total investment of RMB 4 billion.

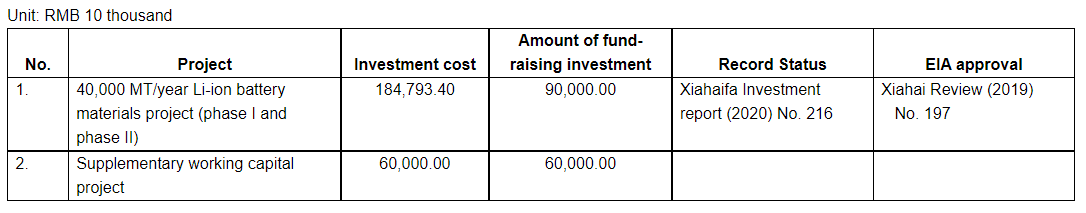

E: Xiamen Tungsten

On August 2, 2021, Xiamen Tungsten’s subsidiary Xiamen Tungsten New Energy issued the shares for the first time and prospectus on the GEM, raising a total of RMB 1.54 billion for the 40,000 MT/year lithium-ion battery materials industrialization project (phase I and phase II)

Note: the 40,000 MT/year Li-ion battery materials project will be built in three phases. Among which, the phase I and phase II capacity are the equity investment project with a total capacity of 20,000 MT/year and the investment of RMB 184,793.40 (unit: RMB 10 thousand)

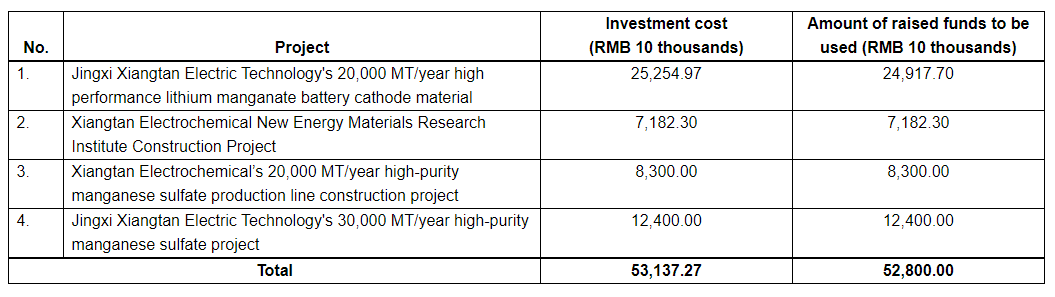

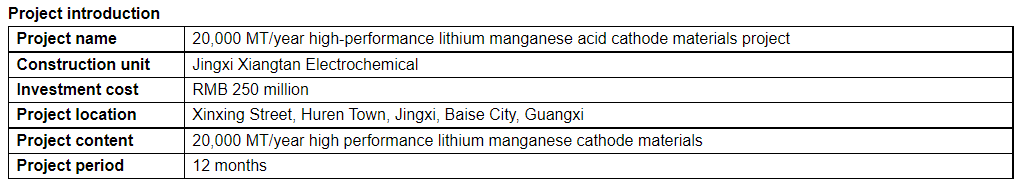

F: Xiangtan Electrochemical

1. 20,000 MT/year high-performance lithium manganese cathode materials project

On February 20, 2020, the pre-proposal of non-public A shares (revised) was issued. The total amount of funds raised from non-public offering will not exceed RMB 528 million (inclusive), and the net funds after deducting the issuance expenses will be used for the following projects.

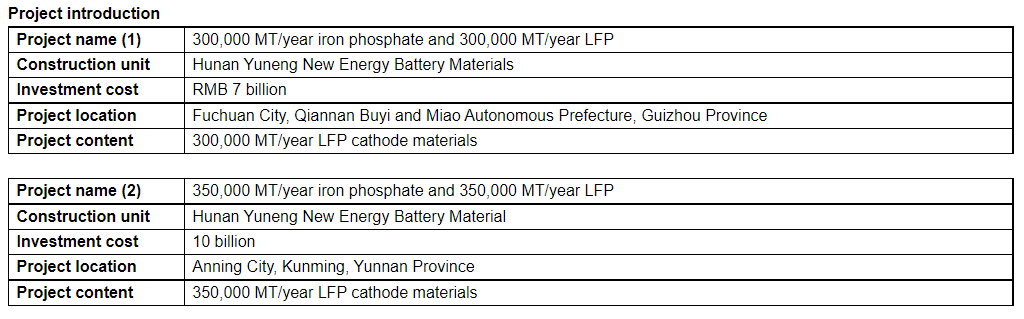

2. Hunan Yuneng Cathode Material Project

On June 26, 2021, Xiangtan Electrochemical announced that, in order to respond to the rapid development of the industry and seize the opportunity of industry development, Hunan Yuneng New Energy Battery Material (Xiangtan Electrochemical’s joint-stock company) will make investment in Fuquan, Guizhou and Anning, Yunnan, respectively.

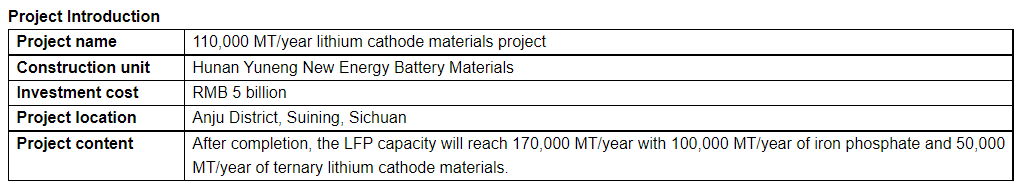

3. 110,000 MT/year lithium cathode materials project

On January 19, 2021, Hunan Yuneng’s 110,000 MT/year lithium cathode material project was settled in Anju District, Suining, Sichuan.

G: Shenzhen Dynanonic

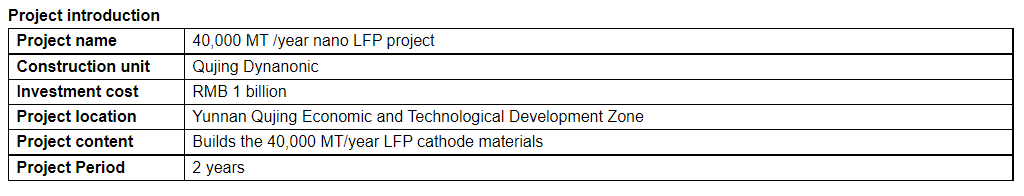

1. 40,000 MT/year Nano LFP project

On April 23, 2020, Dynanonic released the non-public A shares proposal on the GEM. The funds raised by non-public offering totaled RMB 1.2 billion, and the net amount after deducting the issue costs will be used for the 40,000 MT/year nano LFP project and related working capital. The funds used on the two projects will be RMB 850 million and RMB 350 million, respectively.

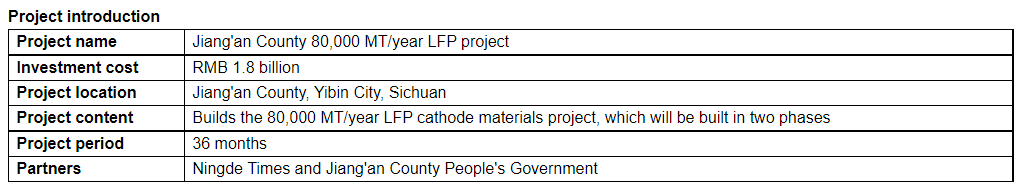

2. Jiang’an County 80,000 MT /year LFP project

On January 19, 2021, Dynanonic announced that it signed up the “80,000 MT/year LFP Project Investment Agreement with Ningde Times and Jiang’an County People’s Government based on the principle of mutual benefit and common development, agreeing to invest and build the 80,000 MT/year LFP project in Jiang’an County, Yibin City, Sichuan, with a total investment of around RMB 1.8 billion

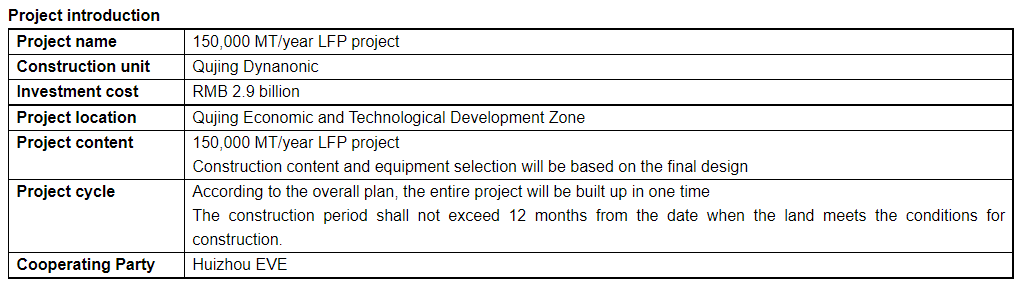

3. 150,000 MT /year LFP project

On March 30, 2021, Dynanonic announced that it plans to build the 150,000 MT/year LFP project at the Qujing Economic and Technological Development Zone. The project includes the 100,000 MT /year LFP project jointly built by the company and Huizhou EVE

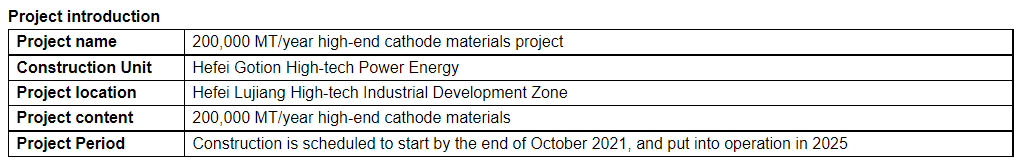

H: Gotion High-tech

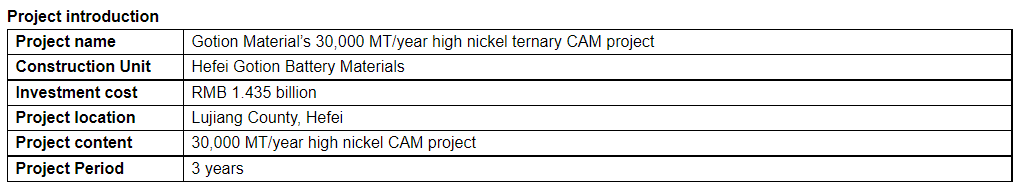

1. Gotion’s 30,000 MT /year high-nickel ternary CAM project

On May 29, 2020, Gotion High-Tech issued the non-public A shares proposal, the total amount of funds raised from the non-public issue shall not exceed RMB 7,306,207,300 (inclusive). According to the agreement between the company and the subscriber Volkswagen China, the total amount of subscription shall not be less than RMB 6 billion, which means the total amount of funds raised shall not be less than RMB 6 billion (inclusive). After deducting the issuance costs, the net funds raised will be used for Gotion Battery’s annual 16 GWh high specific energy power lithium battery industrialization project, Gotion Material’s 30,000 MT/year high nickel ternary CAM project and related working capitals

2. 200,000 MT /year high-end cathode materials project

On July 27, 2021, Gotion announced that its wholly-owned subsidiary, Hefei Gotion High-Tech Power Energy signed up an investment agreement with the Management Committee of Hefei Lujiang High-Tech Industrial Development Zone for the 200,000 MT /year high-end cathode materials project in Lujiang County, Anhui, on July 25, 2021.

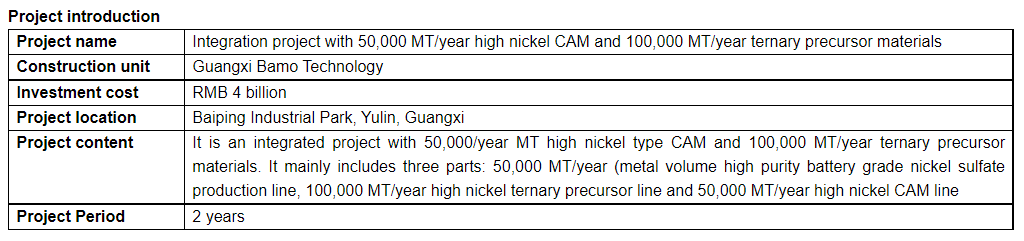

I: Huayou Cobalt

50,000 MT/year high nickel CAM and 100,000 MT ternary precursor integration project

On June 12, 2021, Huayou Cobalt announced that it plans to build an integrated project with 50,000 MT/year high-nickel CAM and 100,000 MT/year ternary precursor materials via its wholly-owned subsidiary Guangxi Bamo Technology

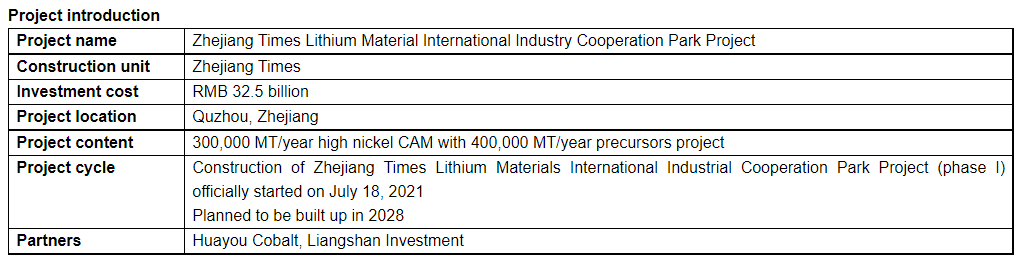

J: Zhejiang Times

Lithium Battery Material International Industry Cooperation Park Project

On May 18, 2021, the Zhejiang Times Lithium Battery Material International Industry Cooperation Park Project was settled in Quzhou.

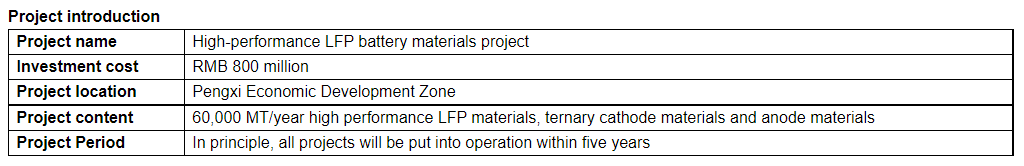

K: Lopal Technology

High-performance LFP lithium battery material project

Jiangsu Lopal signed up an investment agreement with Pengxi County People’s Government on October 10, 2020 to build the high-performance LFP battery materials and engine exhaust treatment fluid project at the Jinqiao area of Pengxi Economic Development Zone. To support the construction of the project, Lopal Technology plans to build a new company with a registered capital of RMB 100 million. The new company will be built by its wholly-owned subsidiary Jiangsu Liyuan Battery Materials, which holds 100% of the shareholding.

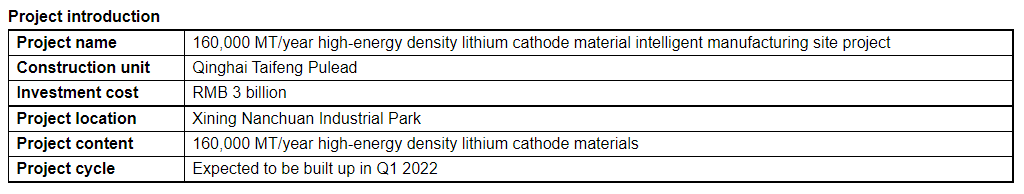

L: Taifeng Pulead

160,000 MT/year high-energy density lithium cathode materials intelligent manufacturing site project

On March 25, 2021, Taifeng Pulead published a tweet on its official Wechat, announcing that the 160,000 MT/year high-energy density lithium cathode materials intelligent manufacturing site project officially kicked off at the Xining Nanchuan Industrial Park.

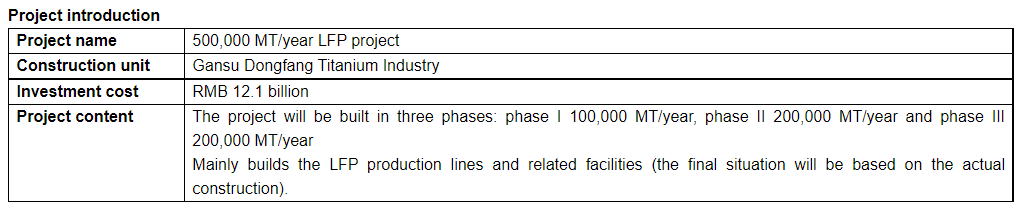

M: CNNC HuayuanTitanium

500,000 MT/year LFP project

On February 4, 2021, CNNC Titanium announced that it planned to build a 500,000 MT/year LFP project through its wholly-owned subsidiary Gansu Dongfang Titanium Industry

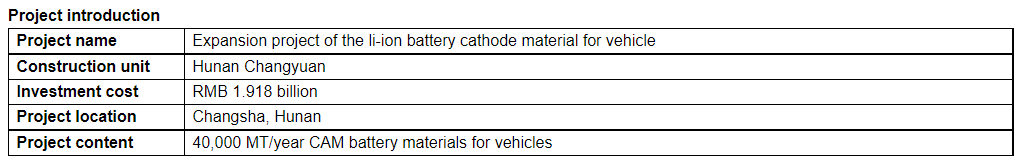

N: Changyuan Lithium Technology

Expansion project of the lithium battery cathode material for vehicles (phase I)

On May 6, 2020, Hunan Changyuan published the prospectus for the public offering of shares (filing) on the GEM for the first time. The company intends to publicly issue no more than 482,301,568 ordinary RMB shares (A shares), and the total amount of funds raised will be determined based on the actual number of shares to be issued and the issue price.

After deducting the issue expenses, the funds raised will be fully used for the projects related to the company’s main business.

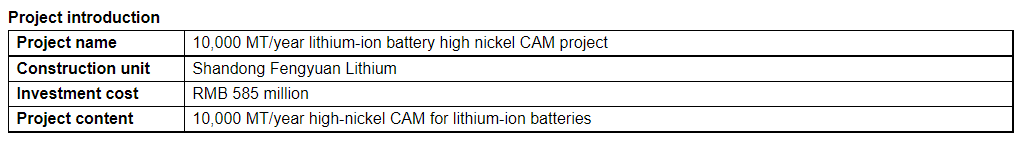

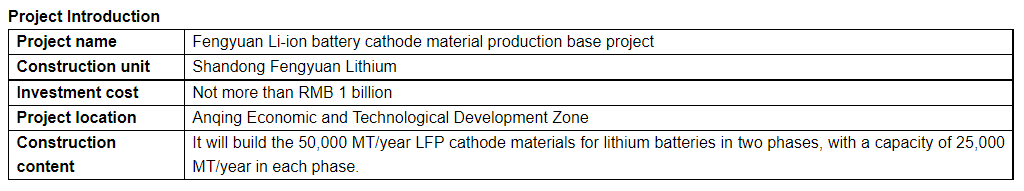

O: Fengyuan Shareholding

1. 10,000 MT/year high nickel CAM for li-ion battery

On February 28, 2020, Fengyuan issued the non-public A-shares proposal, the company’s non-public raised funds is no more than RMB 450 million. After deducting the issuance costs, the funds raised will be used in the following projects

2. Li-ion battery cathode material production site of Fengyuan

On August 27, 2021, Fengyuan announced that Shandong Fengyuan Lithium Energy Technology, the wholly-owned subsidiary of the company, planned to sign up the “Investment Cooperation Agreement on Lithium Battery Cathode Material Production Base Project” with the Management Committee of Anqing Economic Development Zone, intending to build the 50,000 MT/year LFP cathode material production base project at the Anqing Economic Development Zone.

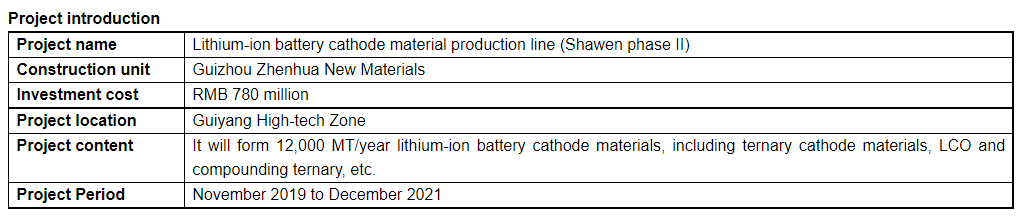

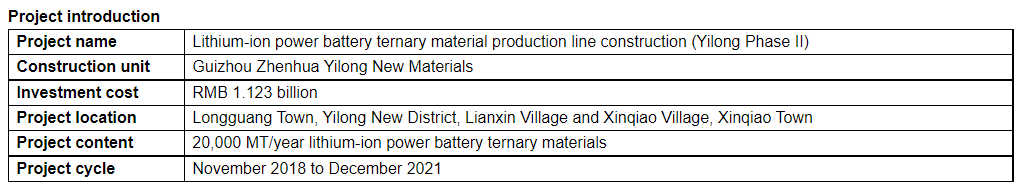

P: Zhenhua New Material

On August 25, 2021, Zhenhua New Material issued a prospectus stating that the company intends to publicly issue 110,733,703 of common RMB shares. After deducting the issue expenses, the funds raised will be invested in the following projects in order of priority

1. Construction project of the Li-ion battery cathode material production line (Shawen phase II)

2. Lithium-ion power battery ternary material production line (Yilong Phase II)

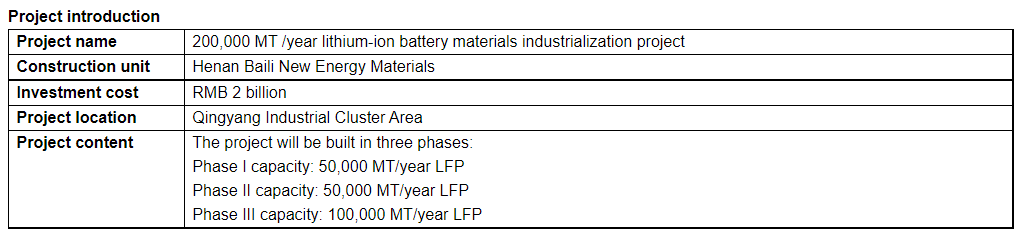

Q: Longbai Group

200,000 MT/year lithium-ion battery materials industrialization project

On August 13, 2021, Longbai Group announced that the company reviewed and approved the “Proposal on the Investment and Construction of 200,000 MT/year Lithium-ion Battery Materials Industrialization Project. In order to obtain the development opportunity of the new energy LFP batteries, Henan Longbai New Material Technology plans to build 200,000 MT/year lithium-ion battery materials industrialization project.

Source: Oriental wealth website, chemical new materials